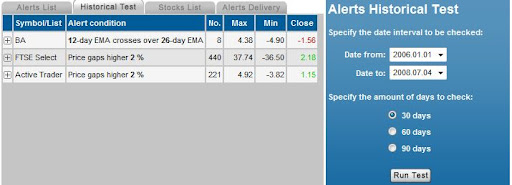

To take this to the next level I tested the traditional 50-day MA cross of the 200-day MA as 'buy' signal; what kind of performance can we expect from this stock alert strategy?

The stocks comprising the historical test were:

Active Trader (US): AAPL, BA, C, CAT, CSCO, DIS, GM, HPQ, IBM, INTC, IP, JPM, KO, MSFT, SBUX, T, WMT

FTSE Select (UK): AGA_L, AVE_L, BB_L, BUR_L, COLT_L, CSR_L, DDT_L, DEB_L, DRX_L, FCAM_L, GFS_L, GNS_L, HIK_L, ISAT_L, LAD_L, LSE_L, MCRO_L, MGNS_L, NFDS_L, PFC_L, PFG_L, PNN_L, RGU_L, RRS_L, SCHE_L, TATE_L, TLW_L, UKC_L

Test period: 30, 60 and 90 trading days.

The FTSE group of stocks performed erratically; the maximum gain ranged from 6 to 13%, but the range for losses was also comparable at -9 to -13%. Consequently, there was very little edge over the three test periods

FTSE Select 30-, 60-, 90-day return

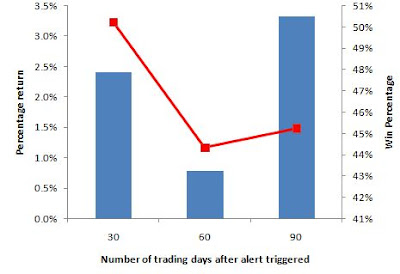

The Active Trader list performed far better with consistently higher gains over time; the gains ranged from 7% to 15% with losses a more manageable -5 to -8%. The win percentage was also very respectable in the 63% to 67% range.

Active Trader Select 30-, 60-, 90-day return

The next strategy lab will look into the performance of this strategy with a 15% profit target and a range of protective stops from 3% to 8%. How will it perform against the returns from the 2% breakout gap strategy? This will be my next blog article.

Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts, market alerts, and stock charts website