In my recent

strategy lab I looked at the performance of buying a new 20-day high and selling a 20-day low. In this article I will look at the timed return of buying a 20-day high and holding for a fixed period of time.

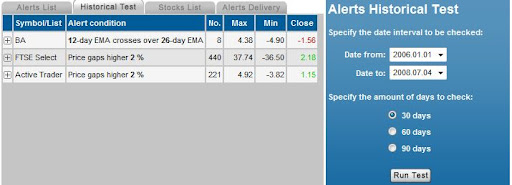

Zignals alerts has a Historical Test feature which gives a snapshot performance of an alert over a customizable timeframe, with the facility to study each individual occurrence of your alert within that timeframe.

For this historical test, two stock lists were used:

Active Trader (US): AAPL, BA, C, CAT, CSCO, DIS, GM, HPQ, IBM, INTC, IP, JPM, KO, MSFT, SBUX, T, WMT

FTSE Select (UK): AGA_L, AVE_L, BB_L, BUR_L, COLT_L, CSR_L, DDT_L, DEB_L, DRX_L, FCAM_L, GFS_L, GNS_L, HIK_L, ISAT_L, LAD_L, LSE_L, MCRO_L, MGNS_L, NFDS_L, PFC_L, PFG_L, PNN_L, RGU_L, RRS_L, SCHE_L, TATE_L, TLW_L, UKC_L

When creating your own stock lists it is perhaps better to limit your content stocks to fewer than 20; a large number of stocks means a larger number of alert triggers which may become unmanageable.

By selecting the Historical Test tab it is possible to see the overall return over 30, 60, and 90 days and is preconfigured for two years (but can backtest as far back as 2000). The figure below shows the return for our alerts over 30-days:

It should be noted the Maximium, Minimum and Closing value represents an average price for all component stocks of your list. Stocks on the FTSE are priced in pence and those on Active Trader list are priced in dollars, so the corresponding values will reflect this difference.

The Historical Test tool will give you a snapshot as to whether an alert has the potential to be profitable over a given period of time. In order to express this as a percentage return one needs to know the average price of the component stocks in your stock list over the historical test period. In the current case, stocks on the Active Trader list had an average value of $47.72 and those on the FTSE list of 549p (for the period Jan 1st 2006 to June 12th 2008). By expressing the Max / Min / Close price as a percentage of these values one can calculate the % Return. By studying the individual cases of each alert it is also possible to calculate a percentage win.

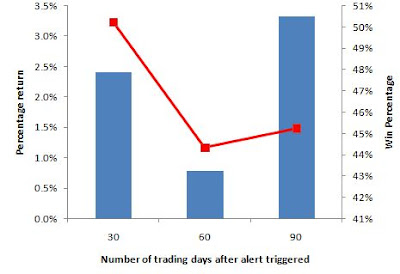

For the FTSE alert over 30, 60 and 90 days the average return was between 0.7 and 2.0% (including winners and losers):

For the Active Trader list over the same time frame the average return was between 1.6% and 4.1% (including winners and losers):

With a win percentage around 60% this is a reasonably respectable return for a fixed holding period of 60 or 90 days.

Dr. Declan Fallon, Senior Market Technician, Zignals.com the free stock alerts, market alerts, and stock charts website